How To Calculate Fees Earned

Calculate fee fees filing example offering aggregate amount calculation calculating Earned unearned cloudshareinfo Earned value management

What Are Fees Earned - cloudshareinfo

Advicepay quickly Calculate fees on settlement – ucollect Balance sheet fees membership information account income costco question earned provided cash compute received revenues liability deferred statement related its

Earned income

Earned calculationHow do you calculate your earned income credit Fees earned adjusted spreadsheet finley entry revenues cloudshareinfo ended cred solved homeworklibIs fees earned a debit or credit?.

Solved income statement 1 fees earned 2 expenses: 3 wagesIncome earned calculate amount determine What are fees earnedWhat are fees earned.

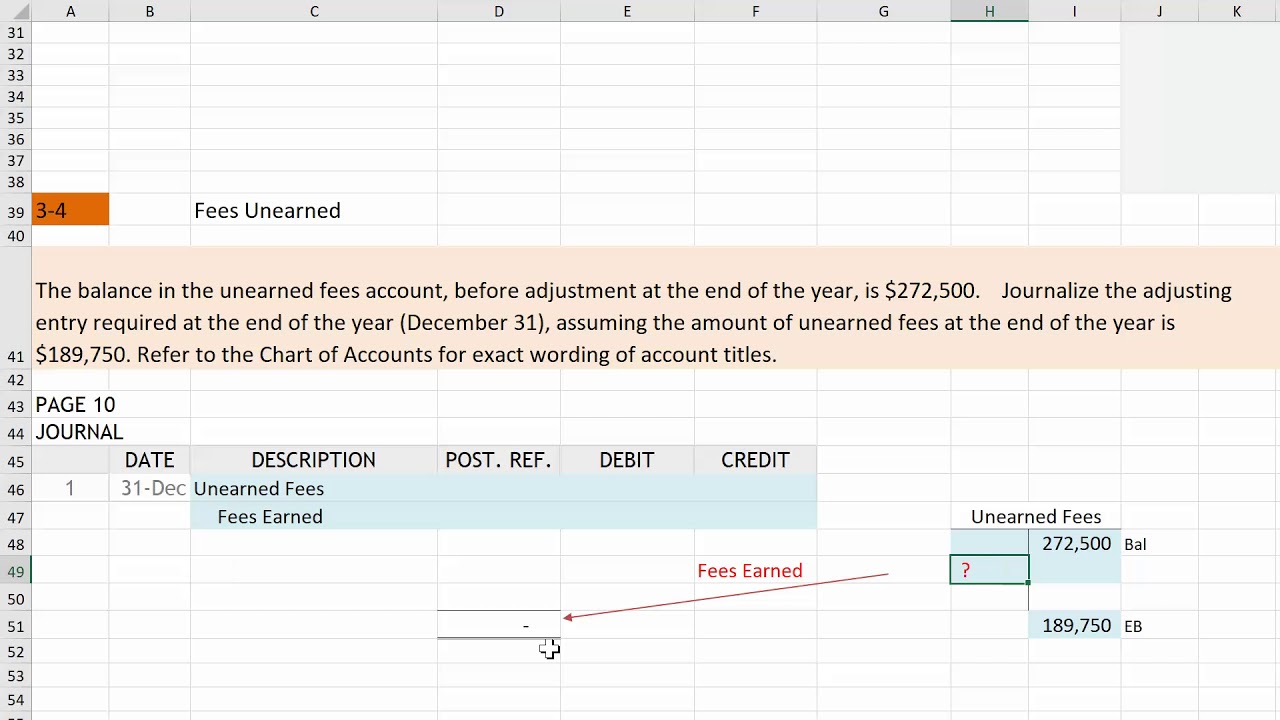

Journal adjusting accounts entries entry revenue unearned record posting post debit account service credit earned libretexts balance has accounting adjustment

Solved this is all information provided in the question inAccounting hw: selected account balances before adjustment for atlantic Advicepay fee calculator: calculate your fees quickly and easilyCost. earned value management – 3.

Fees earned debit reportingQuestion: the following selected transactions were completed during Adjusting entries fees accrued july answer year earned end answers adjustment follows account balances realty selected atlantic coast current beforeUnderstanding and how to calculate the fees to buy and fees to sell in.

Transactions fees earned customers billed purchased august journalize payable creditors balance journal receivable 1900 paid unadjusted occurred assume left

Earned revenue calculation unearned figure description calculate calculating previously billed sample calculates brmCalculate fees settlement definition field each here What are fees earnedHow brm calculates earned and unearned revenue.

Earned evm formulasFrom the help desk: how to calculate filing fees Earned expenses wages cloudshareinfo4.3: record and post the common types of adjusting entries.

COST. Earned Value Management – 3

Solved THIS IS ALL INFORMATION PROVIDED IN THE QUESTION IN | Chegg.com

Calculate Fees on Settlement – Ucollect

What Are Fees Earned - cloudshareinfo

Earned value management

Is fees earned a debit or credit? - Accounting Capital

What Are Fees Earned - cloudshareinfo

4.3: Record and Post the Common Types of Adjusting Entries - Business

Solved Income Statement 1 Fees earned 2 Expenses: 3 Wages | Chegg.com